Online salary tax calculator

For example if an employee earns 1500 per week the individuals. Annual income tax approximately Rs.

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

Ad They did an excellent job.

. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Review real professional profiles see prior experience and compare prices in one place. Enter your info to see your.

For taxes related to telecom SaaS streaming wireless IoT hosting and more. The tax calculator will help you see how the governments deductions impact what you get to take home. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

How to Use the Online Income Tax Calculator. Ad Get the Paycheck Tools your competitors are already using - Start Now. Subtract any deductions and.

It will confirm the deductions you include on your. More than simply software Sovos wants to be your end-to-end partner in tax compliance. Get Started Today with 1 Month Free.

Your household income location filing status and number of personal. Ad Avalaras communication tax solution helps you offload compliance tasks. Get Your Quote Today with SurePayroll.

Assessment Year Tax Payer Male Female. Next select the Filing Status drop down menu and choose which option applies. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Follow the below-given steps to use the tax calculator. This website gives you exact and up-to date tax on your salary without even single click. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Even if youre considering different mortgages we can give you something to think. Enter Your Details Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how much tax youll pay over the year. First enter your Gross Salary amount where shown.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. 28475 as per old tax regime Annual income tax approximately Rs. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Income and Tax Calculator As amended upto Finance Act 2022 Income and Tax Calculator Click here to view relevant Act Rule. Ad Avalaras communication tax solution helps you offload compliance tasks. This number is the gross pay per pay period.

78000 as per new tax. Since salary calculations are often tedious most. Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

That means that your net pay will be 43041 per year or 3587 per month. Ad Sovos combines tax automation with a human touch. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Reach out to learn how we can help you. I hired them again and they did a great job with that too.

Choose the assessment year for which you want to calculate the tax In the next. All Services Backed by Tax Guarantee. Using the United States Tax Calculator is fairly simple.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. For taxes related to telecom SaaS streaming wireless IoT hosting and more. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Assessment Year Tax Payer Male Female Senior Citizen. Discover Helpful Information And Resources On Taxes From AARP. Just enter your monthly salary and your monthly tax will be on your screen.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Its so easy to. Your average tax rate.

Important Note on Calculator. Sage Income Tax Calculator. Income Tax Department Tax Tools Tax Calculator As amended upto Finance Act 2022 Tax Calculator Click here to view relevant Act Rule.

Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

How To Calculate Income Tax In Excel

How Is Taxable Income Calculated How To Calculate Tax Liability

How To Calculate Income Tax On Salary With Example

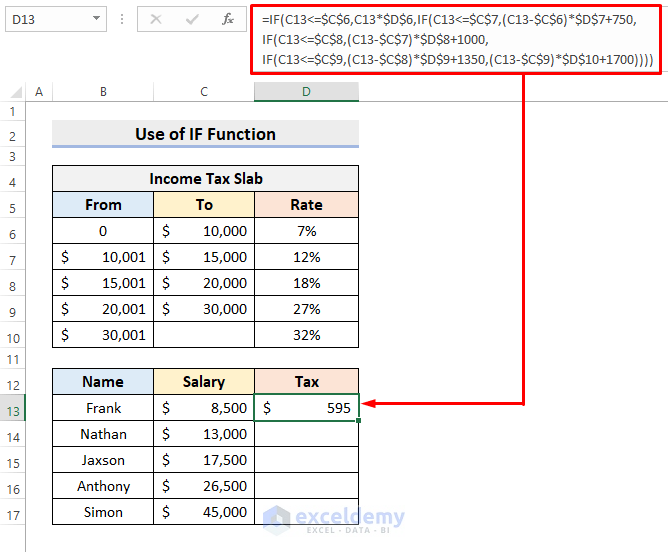

How To Calculate Income Tax In Excel Using If Function With Easy Steps

Income Tax Formula Excel University

Income Tax Formula Excel University

Income Tax Calculating Formula In Excel Javatpoint

Paycheck Calculator Take Home Pay Calculator

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

Paycheck Calculator Take Home Pay Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary With Example

Income Tax Formula Excel University

Calculate Income Tax In Excel How To Calculate Income Tax In Excel